The code has already triggered 44 profit events since January, worth upwards of $38 billion…

Opportunity #45 could hit as early as tomorrow…

Dear reader,

It only took four days for Newton’s Code to mint its latest fortune.

But the story started 11 months prior.

It happened quietly with very little fanfare.

The trigger occurred when company executives from Columbia Sportswear (COLM) struck a sweetheart deal.

They slapped $190 million on the bargaining table in hopes of making a strategic acquisition.

Their target? Privately owned company, prAna Apparel.

PrAna makes sustainable, earth-friendly clothing for yoga enthusiasts.

It operates within a booming sub-niche of the apparel business.

The company started in a married couple’s southern California garage.

It quickly grew into a national threat.

Well, Columbia Sportswear got what it coveted so much.

PrAna execs bit on the deal.

In exchange for $190 million, industry giant Columbia Sportswear acquired prAna.

On the handshake, it became a global player in the thriving yoga apparel industry. The cute yoga couple, who once shipped clothing orders in fruit boxes, parachuted out with millions.

The Handshake Activated Newton’s Code…

I mean that literally.

Newton’s Code began working its magic the moment the two parties inked the deal.

Of course, nobody knew it at the time.

So what exactly triggered Newton’s Code?

It’s simple, really.

As a direct consequence of the deal, a profound shift had occurred.

The “E” (earnings) in Columbia Sportswear’s price-to-earnings ratio (P/E) was no longer correct.

It still reflected the company’s earnings power before the acquisition.

When the “E” is incorrect, the stock price MUST adjust.

Laws of the market dictate that this happen.

Newton’s Code tells us the speed at which the price will adjust.

Let’s revisit that husband-and-wife tandem so you can bear witness to this powerful law of the market.

The couple eventually got in over their head.

They lacked the “know how” to sell yoga apparel beyond American borders.

Columbia Sportswear, however, is a global behemoth.

It knew exactly how to market the booming clothing line internationally.

So on the heels of the acquisition and a global product rollout, Columbia Sportswear’s earnings were poised to expand. (Earnings are simply the net profits of a business.)

It was a virtual certainty.

Again, when the “E” is no longer correct, the stock price must adjust.

Allow me to show you how easy this law of the market works…

A stock’s P/E simply tells us how much investors are willing to pay per dollar of earnings.

High-growth stocks – companies growing earnings – have high P/Es.

Low-growth stocks – companies with stagnant earnings – have low P/Es.

Let’s say Columbia Sportswear earns $1 per share.

If the stock trades for $20, then it has a P/E of 20.

~~~~~~ $20 (stock price) divided by $1 (EPS) equals 20 (P/E) ~~~~~~

But what if Columbia Sportswear suddenly begins earning $2 per share?

Well, then its P/E would suddenly be cut in half to 10.

~~~~~~ $20 (stock price) divided by $2 (EPS) equals 10 (P/E) ~~~~~~

Now we have a severe imbalance…

Because a stock’s P/E would never decline in the face of higher earnings.

If anything, higher earnings would cause Columbia Sportswear’s P/E to increase. Not decrease.

So something MUST occur for Columbia Sportswear to regain its true P/E of 20.

That “something” can only be one thing…

Its stock price must “autocorrect” to $40.

~~~~~~ $40 (stock price) divided by $2 (EPS) equals 20 (P/E) ~~~~~~

See? By moving to $40, Columbia Sportswear has restored its true P/E of 20.

You’ll recall that laws of the market dictate that this happen.

It can be no other way.

In fact, it’s already happened 44 times so far this year.

Forty-four companies have announced “upside surprises” on earnings.

So the “E” has been wrong 44 times.

In every instance, shares have raced higher to adjust.

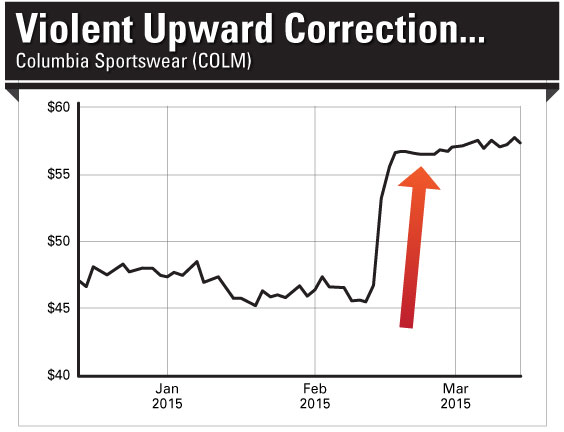

In Columbia Sportswear’s case it only took FOUR days.

Newton’s Code predicted how quickly it would happen.

Validation came when Columbia Sportswear filed its Earnings Report with the SEC…

The report proved everything.

It showed that the company had beaten Wall Street expectations on earnings and revenue.

Management even raised its outlook for the next quarter.

In analyst parlance, we call that a powerful “Triple Beat.”

The stock raced higher over four action-packed days.

Freescale Semiconductor (FSL) is enjoying a boom, as well.

Up until a month ago, it looked like an ordinary semiconductor maker.

Heck, it was ordinary for the last five years!

But without anyone noticing, the company made an earth-shattering move last year.

It began manufacturing chips specifically designed to connect cars to the internet.

Such chips now come equipped in virtually every new car.

If you’ve purchased one lately, it likely has a Freescale chip inside.

The moment management decided to radically shift its business, Newton’s Code activated.

In other words, the clock started ticking.

Freescale’s profits were certain to expand.

So the “E” (earnings) in its P/E ratio was suddenly wrong.

The “E” still reflected the company’s operations BEFORE entering the lucrative car/internet market.

Freescale’s stock price had to recalibrate…

These upward recalibrations are typically fast and aggressive.

Think of pulling a rubber band taut, and then letting go.

When the SEC Earnings Report hit in January, it proved everything.

It showed that the company had crushed Wall Street expectations on earnings and revenue.

Just like Columbia Sportswear, management raised its outlook for the next quarter.

Again, we call this a “Triple Beat.”

I’d rank the “Triple Beat” among the most prolific forces in the market.

The stock raced higher over 29 thrilling days.

Laws of the market dictated that this happen.

It can be no other way.

When the “E” is wrong, shares must race higher to restore the true P/E.

Newton’s Code tells us how quickly it will happen.

Obamacare Activates Newton’s Code…

Back in September, news broke that Obamacare was gaining traction.

Up until then, the jury was still out.

Would it work? Or would it fail?

At long last, real metrics arrived.

They came via a report filed by the Centers for Medicare & Medicaid Services (CMS).

Early results were telling.

Per the report, 7.3 million Americans had registered for – and were actively paying for – healthcare plans under Obamacare.

The number was far above many estimates.

Instantly, the news meant that Insperity, Inc.’s “E” was wrong.

Insperity, Inc. (NSP) offers a powerful suite of human resource services.

Its product caters to small- and medium-sized businesses across the United States.

Obamacare has been a terror for HR departments.

HR departments are directly downwind from healthcare reform because they handle a companies’ insurance coverage.

In fact, Obamacare has stretched virtually every HR department in America to its limit.

Insperity to the rescue…

Its product allows businesses to outsource all of their HR needs.

The company even includes healthcare coverage through a partnership with UnitedHealthcare (UNH).

What a godsend, right?

In response to the healthcare boom, Insperity’s profit base had to expand.

So the “E” (earnings) in its P/E ratio was suddenly wrong…

The “E” still reflected the company’s operations when Obamacare seemed to be hanging in limbo.

Insperity’s stock price had to recalibrate…

Imagine the jolt you feel when a plane starts down the runway.

Well, these upward recalibrations are similarly ferocious and fast.

When the SEC Earnings Report hit in February, it validated everything.

It showed that the company had crushed Wall Street expectations on earnings and revenue.

Management raised its outlook for the next quarter, too.

Another “Triple Beat.”

The stock raced higher over 17 electrifying days.

Laws of the market dictated that this happen.

It can be no other way.

When the “E” is wrong, shares must move higher to restore the true P/E.

Newton’s Code tells us how quickly it will happen.

The Secret Force Behind Every Successful Company…

My name is Robert Williams.

Although I’m the Founder of Wall Street Daily, I’m probably best known for having an authoritative voice on these types of stocks.

In my world, they’re known as “super-momentum” stocks.

I first discovered the concept of super-momentum about 11 years ago.

The discovery came during my tenure as the lead financial analyst for a Forbes Top 50 private corporation.

In that role, I was tasked with writing the company’s earnings reports.

My boss was as tough as nails.

He was demanding.

He was arrogant.

Every morning, when my alarm clock sounded, I sunk deeper into my bed before getting up.

You might know the feeling I’m talking about…

It’s when you’re virtually guaranteed to have a bad day.

Yes… my boss was that tough.

But looking back now, it was the best experience of my life.

He shaped me into the earnings expert that I’ve become today.

Just like a blacksmith hammering hot iron on an anvil, he pounded the secret to fast-moving stocks deep into my soul.

What’s the secret?

Shifting the Profit-Paradigm…

I’ve moved millions of dollars around the capital markets, and hatched countless millions more into the economy.

I’ve worked alongside venture capitalists, multi-million-dollar hedge fund managers, and even billionaire owners of major professional sports franchises.

In fact, since launching Wall Street Daily, it’s estimated that I’ve helped unlock $26 million in new investor wealth.

Still, the single most incredible pearl of wisdom I’ve ever discovered is this…

Share price follows earnings. Period.

If you can identify companies expanding their profits, you can get rich. Very quickly.

In fact, by targeting ONLY companies whose “E” is wrong, you can shave 20 years off your retirement.

Just ask bestselling author, Alexander Green, who says in his book…

“Look back through history and try to find even a single company that increased its earnings, and the stock didn’t tag along.”

Good luck finding such a company, though!

(I say that as the researcher and editor of Mr. Green’s bestselling book.)

When a company’s profit-paradigm shifts, its stock price must adjust.

Laws of the market dictate that it happen.

It doesn’t matter if North Korea tests a nuke.

It doesn’t matter if ISIS blows up a refinery.

It doesn’t even matter if the dollar crashes.

If a company expands its earnings – that is, the net profits of a business – it must race higher.

Of course, there may be some short-term gyrations in the stock price.

But over time, this “earnings” secret holds true every time.

Newton’s Code tells us how quickly it will happen…

Please don’t recoil when you see the formula.

I promise that it’s as elementary as stacking Legos.

Are you ready? Okay, here goes…

The β stands for “beta.”

Beta measures the expected price fluctuations of a stock.

A beta of 1.0 indicates that a stock will move exactly in tandem with the market.

A beta of less than 1.0 means that a stock will move slower than the market.

A beta of GREATER than 1.0 tells us that a stock will move FASTER than the market.

Stocks with betas greater than 1.29 are what I consider to be in the “hot zone.”

Such stocks are theoretically 29% more volatile than the market, which means they move with lightning-quick speed.

I told you it was easy!

So Newton’s Code just gave you another important insight into super-momentum stocks.

In order to qualify as a super-momentum stock, two characteristics should exist…

- The company’s earnings must be expected to increase. (The “E” is wrong.)

- The company’s beta should ideally be greater than 1.29. It means that the inevitable price recalibration will occur at breakneck speeds.

You can find the value of beta for any stock on websites like Yahoo! Finance.

The second part of Newton’s code is even simpler.

“High-Beta” Stocks Raised to the Power of PEAD…

Companies that make “surprise” earnings announcements are grossly mispriced, and highly subject to violent upward momentum.

I’ve been beating this drum all along.

But now researchers have scientific evidence to prove it.

They even have a name for it.

It’s a phenomenon called the “Post Earnings Announcement Drift.”

Or “PEAD” for short.

PEAD is rooted in human psychology.

When game-changing earnings information hits the public, investors lack the agility to react.

Traditional stocks take as long as 90 days for the price to fully adjust.

The adjustment occurs much faster with high-beta stocks.

So the PEAD phenomenon can introduce a much-needed element of certainty into your stock investing.

For example, PEAD held true in our case study on Columbia Sportswear.

You’ll recall that Columbia Sportswear conquered the lucrative yoga apparel industry through a strategic acquisition.

The result? Its stock price was forced to “autocorrect” higher.

PEAD held true when Freescale Semiconductor moved into the booming cars-to-internet industry.

The result? Its stock price had to recalibrate higher.

PEAD held true when Insperity, Inc. experienced a mega boom from Obamacare.

The result? Its stock price was also forced to the moon.

Nobel Laureate, Eugene Fama, calls PEAD “above suspicion”…

Fama is regarded as the “Father of Modern Finance,” and even won a Nobel Prize for his work.

Harvard University and the prestigious Journal of Finance back him up.

It’s hard to argue the contrary!

In all 44 cases this year – where companies made “surprise” earnings announcements – PEAD pushed shares higher each time.

In fact, those 44 cases have added $38 billion in value to the stock market.

It can be no other way.

Laws of the market dictate that it MUST happen.

When the “E” is wrong, stocks are forced aggressively higher.

Newton’s Code can help you shrink the timeframe in which it will happen.

I recommend investing in stocks with betas greater than 1.29.

PEAD will do the rest for you.

Ready to Unleash Newton’s Code for Real?

The merits of investing in these special stocks – super-momentum stocks – are well documented.

Heck, Newton’s First Law says everything…

“An object in motion stays in motion.”

Yet the real charm of super-momentum stocks isn’t their upward motion.

It’s more about their infinite reliability.

This reliability affords investors certain luxuries, like…

- Slashing your average holding period down from 180 days to 14 days.

- Earning a 30% return for every 1% move on a stock.

- Re-upping winning trades over and over again.

Powerful, wouldn’t you agree?

America’s most-celebrated billionaires definitely agree.

Super-momentum stocks are favored among billionaires like Warren Buffett, David Einhorn, George Soros and John Paulson.

They’ve helped mint endless fortunes, with no end in sight. Safely, too!

Well, are you ready to take the next step?

Because my next Super-Momentum Program launches on Monday morning.

See the dates to your right?

They’re called “clawback dates.”

Over the next three months, an inner circle of my best readers will enjoy eight such clawback opportunities, each one building on top of the next.

Collectively, at stake is up to $40.7 million in new investor wealth.

It translates to roughly $81,573 per person.

How can I be so precise? I’ll reveal everything in just a moment. But first…

Here’s how my Super-Momentum Program works…

A few weeks ago, some of the most powerful billionaires in the world scored big on a special situation concerning Steve Jobs’ former company, Apple.

Apple had just released an “earnings surprise,” instantly making it a super-momentum candidate.

The trade netted them a profit of $550 million in less than 24 hours.

I’ll introduce you to these celebrated billionaires in a moment.

But first, just know that the trade was “business as usual” for them.

Super-momentum stocks lie at the heart of every billionaire’s investment strategy.

For me, however, the trade was a landmark.

You see, I’ve been tracking a pattern of super-momentum trading among billionaires for the better part of a decade.

By my best estimates, the Apple trade was the THOUSANDTH time I’ve observed them make the exact same trade.

Every trade has enjoyed the same outcome, too.

A thousand trades, a thousand winners.

Yes, you read that correctly…

The trade has proven effective every time I’ve witnessed it, without fail.

So now, 10 years later, my antennas have become hyper-acute.

I see the trades as they happen in real-time.

Having such insight gives my most ambitious readers a chance to share in the glory.

Checkmate the market in three simple moves…

Each of these super-momentum trades – made by legendary billionaires – can be broken down into three simple parts.

Again, this is a pattern I’ve witnessed repeat itself over and over, hundreds of times.

I’ve never seen it fail to generate profits.

The first part of the trade is called the “Pitch.”

During the Pitch, the billionaire buys what appears to be an ordinary stock.

Perhaps it’s shares of Corning, Google, Priceline… or the most recent target, Apple.

Nothing about the purchase seems out of the ordinary.

On the surface, it’s a safe, well-managed, fundamentally sound company that typically pays a nice dividend, as well.

It’s the kind of stock that everyone should have in their retirement portfolio.

But of course, this is no ordinary stock.

It’s a super-momentum stock, which means it’s subject to violent upward price corrections.

The second part of the trade is called the “Turn”…

During the Turn, the billionaires’ shares do something extraordinary.

Since the “E” is wrong, shares suddenly spike aggressively higher.

When you’ve seen it happen a thousand times (as I have), you quickly become smitten.

Stocks aren’t supposed to behave with such absolute certainty, right?

But super-momentum stocks are wired differently.

In essence, the billionaire cheats time.

He shrinks the duration that it normally takes to earn big profits down to hours instead of weeks and months.

Gains can run as high as 100% in an instant.

You could place a trade from the tarmac in Boston, and have made $10,000 as you get off the plane in San Francisco.

In fact, people have done exactly that!

Now, of course, most of these legendary billionaires run wildly successful hedge funds.

The minimum to invest in their funds typically runs north of $50 million.

Investors demand performance.

It’s cutthroat, and highly competitive among fellow billionaires.

So making $550 million on Apple alone won’t suffice.

That's why every super-momentum trade needs a third part.

It’s the hardest part.

The part I call the “Clawback.”

My next Super-Momentum Program starts Monday morning…

The clawback leg of the trade is what makes it so breathtaking.

It’s at the heart of every hedge fund strategy.

It’s what keeps investors depositing more money, and rarely (if ever) withdrawing funds.

By “Clawback,” I mean the trade repeats itself.

Simply sell the winners and roll your profits into the next opportunity.

There will never be a shortage of super-momentum stocks. That is, if you know where to look.

Heck, the markets have already witnessed 44 winners so far this year.

Collectively, they’ve unlocked upwards of $38 billion in profits.

It’s like déjà vu.

The outcome is the same every time.

I’ve now witnessed a thousand super-momentum trades over the last 10 years, and not a single one has ever bombed.

So when the billionaires make their next trade, why not clawback some of the profits for yourself, right?

Think of super-momentum stocks like a Rolex watch, a mechanical wonder that NEVER misfires.

Or a convertible Aston Martin, a classic that NEVER disappoints.

The idea is to start small and let the proceeds snowball.

When the program ends – exactly one quarter from Monday – at stake will be up to $40.7 million spread across 500 of my best readers.

It works out to roughly $81,573 per person.

Yes, financial freedom can be this easy…

My Super-Momentum Program is powerful enough that a modest investment can start to snowball very quickly.

In fact, $1,000 is my recommended baseline amount to start.

Now, I realize that $1,000 is almost an inconsequential amount.

But it’s plenty to supercharge any retirement.

Yet, despite my urging, most readers choose to invest more.

Among 500 readers – some investing big, some investing small – I’d say it averages out to around $10,000.

Well, earning 30% Clawbacks eight times over the next three months works out to $81,573 per person.

Your amount will depend on your own personal ambition.

Feel free to tailor my program however suits you best.

Here, take a look of some recent winners we’ve enjoyed, and please notice the compressed timeframes…

Identifying the legends…

Okay, so who are these legendary billionaires?

And how have they executed the same super-momentum trade over a thousand times, and seldom – if ever – lost?

Well, my list is comprised of 20 extraordinary men.

Eight of which just participated in the windfall on Apple’s stock.

The trade generated $550 million in new investor wealth in less than 24 hours.

When it comes to these powerful billionaires, you’ll recall that their trades have three parts.

- During the Pitch, they bought what appeared to be an ordinary stock. But it wasn’t. It was a super-momentum stock.

- During the Turn, shares suddenly went ballistic, surprising virtually everyone. But it won’t surprise you. You know that the “E” must be wrong.

- The trade is guaranteed to happen again (the Clawback). It’s already happened 44 times so far this year.

Will Apple (once again) be the target of the next clawback?

Or will it be shares of another super-momentum candidate like, say… Intel, Time Warner, or Goldman Sachs?

I don’t know the answer at this very moment.

But in a few hours, I’ll have 100% certainty…

It all hinges on who announces an “earnings surprise” next.

In the hedge fund world, they say, “A wolf never leaves the deer after once tasting his blood.”

Well, I embody that saying.

I track these billionaires methodically, and I know where every clawback is coming from next.

With that in mind, here are the 20 influencers behind my Super-Momentum Program…

Now, of course, these gentlemen do make losing trades.

The overarching health of the market can negatively influence returns.

Such is the nature of investing.

But seldom – if ever – do these billionaires get it wrong when it concerns super-momentum stocks.

Want proof?

With the help of super-momentum stocks, Carl Icahn has been crushing the benchmark indexes.

The same goes for Daniel Loeb, Bill Ackman, and virtually every other man on my list.

Start Small, Finish Big…

Look, I don’t need independent research to validate any of this.

I’ve personally witnessed a thousand super-momentum trades over the last 10 years.

They’ve been made by a select handful of billionaires.

Every trade ends with millions in profits. Period.

A thousand trades, a thousand winners.

Nonetheless, my Super-Momentum Program’s methodology is supported by the prestigious Journal of Finance and Journal of Accounting Research.

It’s also backed by independent research from Harvard University, whose endowment is the largest in the world.

You don’t need to be a financial genius to benefit, either.

MarketWatch says, “Even slow-poke traders can take advantage.”

In fact, Forbes recently profiled a fund manager who runs a similarly structured super-momentum strategy.

His program is wildly successful.

It’s valued at $405 million, and growing.

According to Forbes, he’s “making a killing!”

But he’ll charge you upwards of $16,000 a year to enroll.

My research won’t require but a modest investment.

Don’t forget... the idea is to start small and let the proceeds snowball.

By the end of the quarter, every reader who partakes will enjoy the opportunity to become $81,573 richer.

Save your seat, ASAP…

I plan to release my very latest super-momentum opportunity on Monday.

So I’d like to extend you a one-time invitation to join my Program.

To unlock full access, just sign up for a no-risk trial subscription to Extreme Alpha.

Extreme Alpha is my flagship research service dedicated exclusively to super-momentum stocks.

If your retirement date is 20 years out, Extreme Alpha can slash it to five.

If it’s 10 years out, Extreme Alpha can slash it to one.

The moment you become a member, you’ll have immediate access to the following…

|

Strategy Guide #1: The Super-Momentum Program |

|

Strategy Guide #2: The Billionaires’ Secret Blackbook |

|

(3) Deeper-Dive Training Videos: |

Then, beginning Monday, I’ll send you…

In the next few hours, I’ll have 100% certainty about the billionaires’ next target.

Barring some unforeseen event or act of God, the stock will rocket sharply higher.

It’s as predictable as the tides.

I’ve seen the same pattern unfold for 10 years.

According to the Nasdaq exchange, “The pattern keeps stocks rising for weeks and sometimes even months.”

My Super-Momentum Program is perfectly calibrated to benefit from these opportunities as they occur.

Expect no fewer than eight recommendations per quarter.

So that’s 32 super-momentum opportunities over the next year!

I can’t think of a better way to aggressively grow your wealth.

The best part?

My Super-Momentum Program will prove – once and for all – that you don’t need large sums of money to achieve extraordinary wealth.

It only requires a modest investment.

Every reader will have an opportunity to become $81,573 richer in the next three months…

Yearly access to Extreme Alpha only costs $3,000.

It’s a bargain when you consider that the minimum to invest in most hedge funds is $50 million.

Remember the fund manager profiled by Forbes?

He charges upwards of $16,000 to access his like-minded super-momentum strategy.

Although that may seem pricey, it’s standard in the hedge-fund world.

But you don’t have to pay near that amount for my research.

That is, if you take action right now…

As a “Thank You” for participating in this historic training event, I’m offering trainees a cut-rate deal.

If you act today, I'll extend you a one-year membership to Extreme Alpha at the cut-rate price of $1,500.

Plus, you’ll risk nothing for the first 90 days.

If, for any reason during that period, you’re not satisfied with my research, simply call us for a full refund.

So that’s 32 super-momentum opportunities over the course of the next year.

Just click the link below to begin.

Or call us at 1.800.752.0625 or 443.353.4536.

Awaiting you is instant access to my two (2) Strategy Guides and three (3) Deeper-Dive Training Videos.

Then, beginning next week, you’ll receive weekly emails from me.

Monday’s email will contain very specific information concerning your first super-momentum recommendation, including the ticker symbol.

The market has already yielded 44 super-momentum winners so far this year.

Why should the next one be any different?

Again, just click the link below to get started.

Or call us at 1.800.752.0625 or 443.353.4536.

See you on the other side,

Robert Williams

Founder, Extreme Alpha March 2015